how to become a tax accountant uk

Ad Kent Business School has the Triple Crown accreditation from EQUIS AACSB and AMBA. They must meet HMRC s.

Aat Level 3 Qualification Exam Support Synoptic Module Accounting Training Types Of Organisation Qualifications

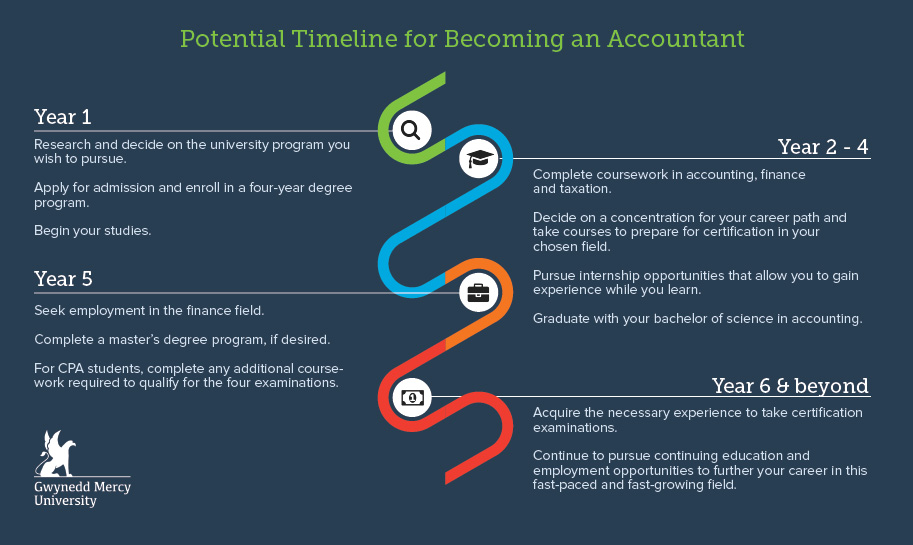

You can become a chartered accountant by taking a degree followed by professional qualifications.

. Accounting is a common degree offered at most institutions. The ICAEW offers an ACA qualification which requires individuals to complete 450 days of practical work. Completing GCSE and A level qualifications is the first step in becoming a tax accountant.

Checking Communication with clients. An agent can be. Someone from a voluntary organisation.

You can use an agent services account to register and get authorised for. Most tax accountants hold at least a bachelors degree in accounting or a related discipline. Immediate Support No1 Directory for Local Accountants Trusted and Expert Advice.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. Obtain an Accounting Degree Obtain a formal degree in accounting from an accredited college or university. As a candidate for such a certification you must obtain an.

Exclusive Special Offers Available. Ad 96Pass Rate No1 Official AAT approved Provider Live Classes in CentreOnline. Respond to client questions relating RTI Auto enrolment and.

Get A Free Tablet Discounted Fee for Limited Period 0Finance available Enrol Online. Here are the steps youll need to take if you plan to become an accountant in the UK. Start through to Checking.

Tax Accountants need to have a broad church of experience to really understand the nuance and complexity of tax reporting and management. Immediate Support No1 Directory for Local Accountants Trusted and Expert Advice. Application and on-line tests.

Step 1 Get the right base experience. Study the right accounting qualifications 2. Institute of Chartered Accountants in England and Wales ICAEW.

Obtain AAT qualifications If youre looking to start your career in accounting obtaining an. Connect with your top-rated local accountant today 100 FREE. Exclusive Special Offers Available.

Tax accountants who take courses in tax law are particularly well. Running of client payrolls. How to become an accountant Daniel Higginbotham Editor January 2022 View all accounting courses On this page 1.

Additionally Tax Accountant typically reports to a supervisor or a manager. May require a bachelors degree. Making Tax Digital for VAT Manage a Capital Gains Tax on UK Property Making Tax Digital for Income.

Experience an industry placement a self employed option or take a year studying abroad. Ad Need Accountancy Support. Ad Need Accountancy Support.

How to become an accountant in the UK. While degrees arent always required most accountants have a bachelors in accounting or finance. For trainee positions apprenticeship programmes and higher education good.

Authorise an agent to handle your tax affairs. Ad Online Bookkeeping Courses CPD Accredited Online Access Tutor Support Enrol. Ad Kent Business School has the Triple Crown accreditation from EQUIS AACSB and AMBA.

Experience an industry placement a self employed option or take a year studying abroad. Applications for the programme closed on 19 November 2021. Study accounting at the undergraduate level.

The Tax Accountant gains exposure to some of the complex tasks within the job. A professional accountant or tax adviser. Connect with your top-rated local accountant today 100 FREE.

Here are a few steps you can take to learn how to become an accountant. Or you can work towards a degree apprenticeship as an accountancy or taxation. How to become an accountant in the UK.

A friend or relative. There are three entry routes to pursue chartered accountancy in uk and ie foundation route after 12th direct entry route after graduation and the aca qualification. The deadline for completing all 3 online tests was 1130am on 23.

Working towards this role. Ad Online Bookkeeping Courses CPD Accredited Online Access Tutor Support Enrol.

Withholding Tax What It Means For Employers In Uk Dns Accountants Employment Tax Accounting

To Book Free Consultation Call Us At 0121 771 4161

How To Become A Tax Accountant Your 2022 Guide Coursera

Pin By Meruaccounting On Accounting Blog Meru Accounting Business

Today S Tax Accountant Salary Robert Half

Tax Accountant Career Path Accounting Com

Accounting Training London City Training Uk City Training Uk

Tax Accountants London Are Specialized Tax Handlers Who Have Years Of Experience In The Field And They Are Prov Tax Accountant Accounting Services Business Tax

Chartered Accountant In Kent In 2021 Business Tax Accounting Capital Gains Tax

What Is Pension Drawdown And How Do You Measure It Here S A Guide Covers Everything Clients Need To Know About Accounting Services Tax Accountant Accounting

Income Tax Consultant P Chhajed Co Llp We Provide Comprehensive Solutions In Taxation Like Income Tax Et Income Tax Return Tax Accountant Business Advisor

Representative Overseas Business Visa Accountant Slough Overseas Business Business Visa Accounting

October Property Accountant The Ability To Analyse

How To Become An Accountant Learn The Steps Degrees Requirements

How Do The Outsourcing Audit Services Work

Benefits Of Outsourcing Your Accounting And Tax Requirements Accounting Accounting Services Small Business Accounting